SoftBank’s $4 Billion DigitalBridge Acquisition: The Pivot to Physical AI Infrastructure

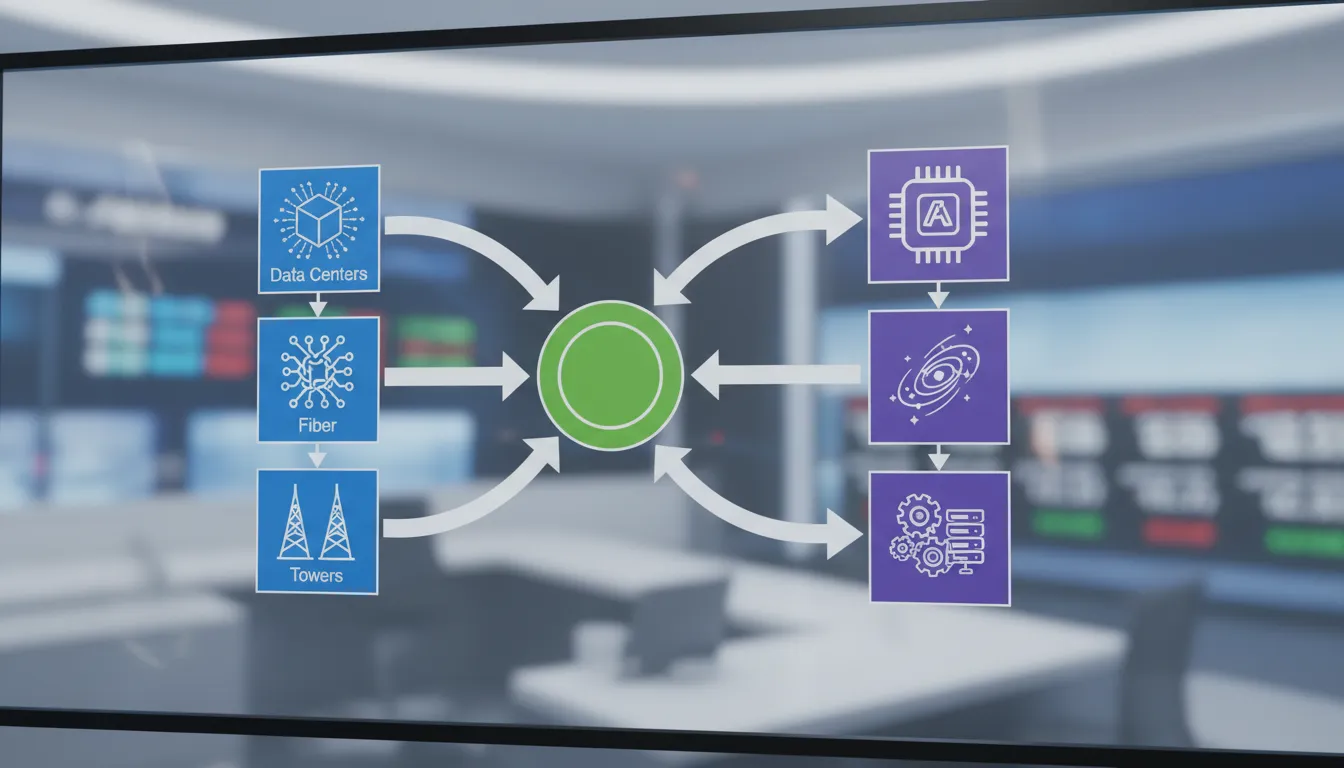

SoftBank Group’s definitive agreement to acquire U.S.-based DigitalBridge Group for approximately $4 billion marks a decisive shift in the global artificial intelligence arms race. By moving from software and model funding to owning the physical “rails” of the AI economy—data centers, fiber networks, and cell towers—SoftBank is effectively hedging its massive bets on AI software with hard assets. For the U.S. market, this transaction signals the beginning of a consolidation phase in digital infrastructure, driven by the insatiable power and compute demands of “Artificial Super Intelligence” (ASI).

Strategic Analysis: The Infrastructure of Intelligence

Securing the “Stargate” Supply Chain

This acquisition is not merely a financial play; it is a logistical necessity for SoftBank’s broader ambitions, specifically the reported “Stargate” project—a $500 billion AI infrastructure initiative involving OpenAI and Oracle. DigitalBridge manages over $100 billion in assets, including key portfolio companies like Vantage Data Centers, Zayo Group, and Switch. These entities control the precise assets required to train massive foundation models: hyperscale data centers, low-latency fiber backbones, and power-dense colocation facilities.

By bringing DigitalBridge in-house, SoftBank secures a direct pipeline to critical U.S. infrastructure, bypassing the volatility of leasing capacity in a supply-constrained market. This vertical integration allows SoftBank to prioritize its own portfolio companies (and partners like OpenAI) in the queue for server space and power allocation.

U.S. Market Impact: Power and Sovereignty

The deal places a Japanese conglomerate at the helm of critical U.S. digital arteries. While DigitalBridge will reportedly operate as an independent platform under CEO Marc Ganzi, the ultimate ownership structure raises questions about data sovereignty and national security. The U.S. market is currently facing a “power crunch” where access to gigawatt-scale electricity is more valuable than the servers themselves. DigitalBridge’s portfolio, particularly Switch, is known for its advanced power capabilities and renewable energy integration, making this a strategic energy play as much as a real estate one.

Comparative Valuation: The Premium for “Picks and Shovels”

The $4 billion enterprise value (approx. $16/share) represents a strategic entry point for SoftBank, especially when compared to the frothy multiples seen in recent comparable transactions. While the absolute dollar figure is lower than the mega-deals of 2021, the strategic premium for active management of these assets has increased.

| Acquirer | Target | Deal Value (Enterprise) | Year | Strategic Context |

|---|---|---|---|---|

| SoftBank Group | DigitalBridge | ~$4.0 Billion | 2025 | Vertical integration for AI “Stargate” project; distressed asset entry. |

| Blackstone | AirTrunk | $16.0 Billion | 2024 | Expansion into APAC hyperscale market; largest data center deal to date. |

| KKR & GIP | CyrusOne | $15.0 Billion | 2021 | Privatization of massive U.S. REIT to fuel long-term capital expenditure. |

| DigitalBridge & IFM | Switch | $11.0 Billion | 2022 | Acquisition of Tier 5® data centers with 100% renewable energy focus. |

| Blackstone | QTS Realty Trust | $10.0 Billion | 2021 | Early aggressive move to secure U.S. hyperscale capacity. |

Regulatory & Consumer FAQ

Will this deal face CFIUS scrutiny?

Yes. The Committee on Foreign Investment in the United States (CFIUS) will almost certainly review this transaction. DigitalBridge controls assets that are critical to U.S. telecommunications and data processing. However, SoftBank has successfully navigated CFIUS reviews before (e.g., Sprint/T-Mobile). The fact that DigitalBridge will remain a U.S.-headquartered entity with existing management may mitigate some concerns, but strict firewall agreements regarding customer data access are likely.

Does this mean higher costs for U.S. tech companies?

Likely not immediately. The market for data center capacity is already constrained, driving prices up regardless of ownership. However, if SoftBank prioritizes its own AI ecosystem for capacity, independent competitors might face longer wait times for colocation space, indirectly increasing their operational costs or time-to-market.

Why is the deal value ($4B) lower than DigitalBridge’s AUM ($108B)?

SoftBank is acquiring the investment management firm (the General Partner), not the entirety of the underlying assets themselves. The $108 billion represents “Assets Under Management” (AUM)—money belonging to limited partners (pension funds, sovereign wealth funds) that DigitalBridge manages. SoftBank is buying the rights to the management fees and the balance sheet investments, effectively purchasing the engine rather than the entire train.

Final Outlook

SoftBank’s acquisition of DigitalBridge is a bellwether event for the U.S. technology sector. It signals that the “easy money” phase of AI—funding startups with pitch decks—is evolving into a capital-intensive industrial phase. For U.S. stakeholders, this means the physical geography of the internet (Northern Virginia, Silicon Valley, Texas) is becoming as strategically vital as the code written in it. We expect this deal to trigger a secondary wave of M&A activity as other tech giants (Microsoft, Amazon, Google) look to lock down their own infrastructure supply chains before the remaining independent operators are absorbed.