Market Wrap: Precious Metals Surge and Nvidia Deal Highlight Quiet Post-Christmas Session

December 27, 2025 – U.S. financial markets reopened Friday for a shortened holiday trading window, characterized by thin volumes and specific sector rotation. While the broader indices paused their record-breaking run, significant activity in the commodities sector and a major acquisition in the semiconductor space provided direction for investors positioning themselves ahead of the New Year. The S&P 500 hovered near the 6,923 mark, consolidating gains after a robust year-to-date performance.

Equities: The “Santa Claus Rally” Pauses

Trading on Friday, December 26, reflected typical post-holiday lethargy, yet the underlying sentiment remains bullish. The session falls squarely within the “Santa Claus Rally” window—historically the last five trading days of the year and the first two of the new year. Despite the lack of aggressive buying power, the downside was limited, suggesting traders are reluctant to offload positions before 2026.

The S&P 500 slipped approximately 8 points (-0.1%) to close around 6,923. The Dow Jones Industrial Average saw a marginal decline of 0.2%, while the tech-heavy Nasdaq Composite remained essentially flat, dipping less than 0.1%. The resilience in technology stocks was largely attributed to renewed deal-making activity.

Tech Spotlight: Nvidia Acquires Groq

The standout story of the last 24 hours is Nvidia’s (NVDA) strategic move to consolidate its dominance in the AI infrastructure space. The chipmaker announced a definitive agreement to acquire AI startup Groq in a deal valued at $20 billion. Nvidia shares rose 1.5% on the news, bucking the broader market trend. Analysts view this acquisition as a direct play to secure specialized inference processing capabilities, further widening Nvidia’s moat against competitors.

Retail Movers: Target’s Activist Interest

In the consumer discretionary sector, Target (TGT) shares advanced 2% following reports of a new stake by a prominent activist investor. The market is anticipating potential operational restructuring or spin-offs to unlock value after a mixed holiday shopping season.

Commodities: Silver and Gold Break Out

While equities remained muted, the commodities complex experienced significant volatility. Precious metals staged a massive rally, driven by a combination of safe-haven demand, supply constraints, and expectations of further Federal Reserve rate cuts in early 2026.

- Silver was the top performer, surging over 4.5% to reach $74.88 per ounce. This dramatic move is underpinned by critical shortages in industrial silver required for solar panels and advanced electronics.

- Gold continued its ascent, gaining 1.1% to trade near a record $4,515 per ounce. The yellow metal continues to attract capital as a hedge against lingering inflation concerns and geopolitical friction.

- Crude Oil (WTI) faced headwinds, trading near $58.45 per barrel. Energy traders are weighing the impact of increased U.S. production against softer global demand forecasts for Q1 2026.

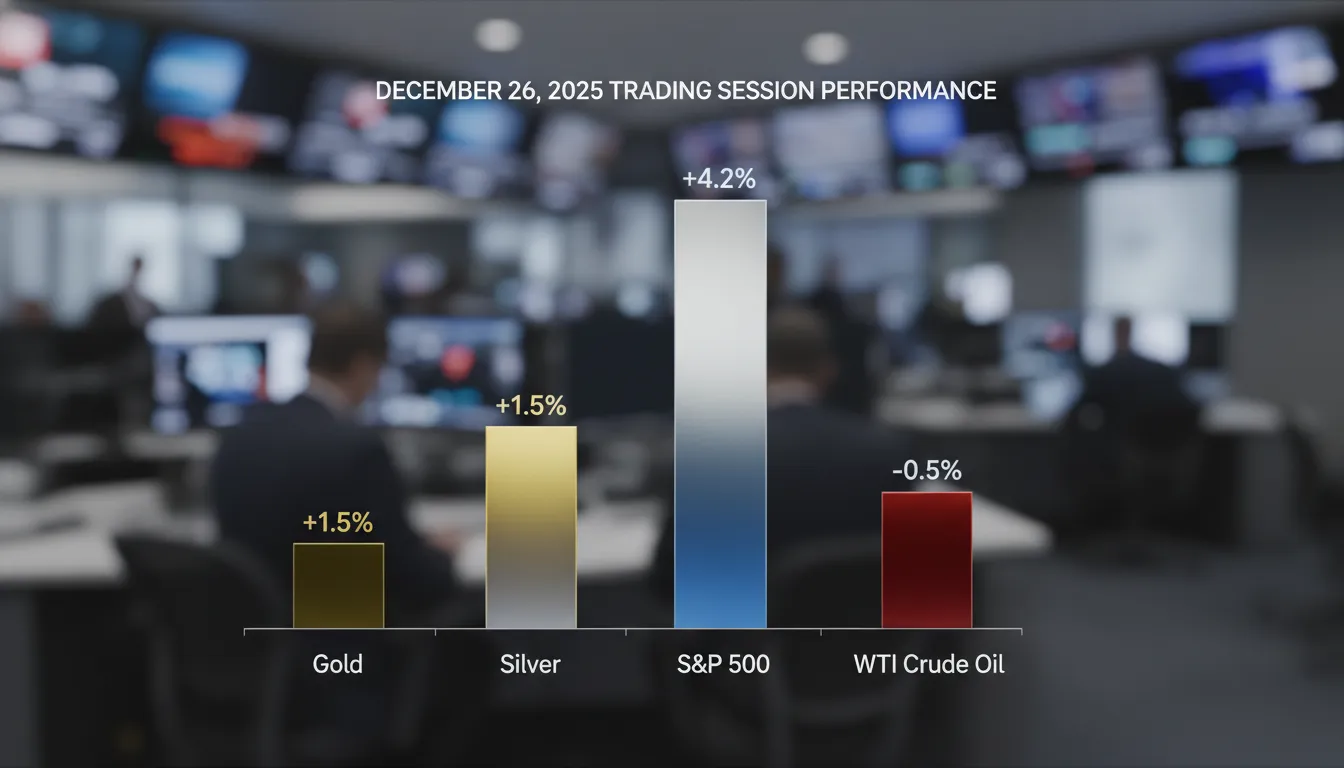

Market Data Snapshot

The following table summarizes key asset performance over the last trading session (December 26, 2025).

| Asset Class | Index/Commodity | Price / Level | Daily Change |

|---|---|---|---|

| Equities | S&P 500 | 6,923 | -0.10% |

| Equities | Nasdaq Composite | 21,450 (Est.) | -0.08% |

| Equities | Nvidia (NVDA) | $168.50 (Est.) | +1.50% |

| Metals | Gold (Spot) | $4,515.00 | +1.10% |

| Metals | Silver (Spot) | $74.88 | +4.52% |

| Energy | WTI Crude | $58.45 | -1.05% |

| Rates | US 10-Year Treasury | 4.15% | +0.02% |

Frequently Asked Questions (FAQ)

Is the stock market open on New Year’s Eve 2025?

Yes, U.S. markets will be open on Wednesday, December 31, 2025. However, the bond market typically closes early (usually 2:00 PM ET). Equity markets are expected to operate regular trading hours, though volume will likely be extremely thin.

Why are silver prices rising so aggressively compared to gold?

Silver is benefiting from a “dual-driver” dynamic. It acts as both a monetary metal (like gold) and a critical industrial input. In late 2025, supply deficits in the industrial sector—specifically for green energy technologies—have exacerbated price movements, causing silver to outperform gold on a percentage basis.

What does the Nvidia-Groq deal mean for AI stocks?

The $20 billion acquisition signals that the consolidation phase of the AI hardware boom is accelerating. For investors, this suggests that larger cap tech stocks may continue to absorb promising startups, potentially validating high valuations in the semiconductor sector. It reduces the likelihood of a “bubble burst” in the near term by demonstrating tangible capital deployment.

Outlook: Positioning for 2026

As we approach the final trading days of 2025, the market narrative is shifting from “chasing growth” to “strategic consolidation.” The 10-year Treasury yield holding steady at 4.15% indicates that bond markets have priced in a stable but not aggressive rate-cut path for the coming year.

For US stakeholders, the immediate focus should be on portfolio rebalancing. The divergence between the soaring precious metals market and the flat equity market suggests a rotation into hard assets is underway. Investors should watch for the “January Effect” next week, where small-cap stocks often outperform as tax-loss selling abates. Expect volatility to remain low until full institutional participation returns on January 5, 2026.