India’s Best Term Insurance Plans (2025): A Strategic Guide for US Investors & NRIs

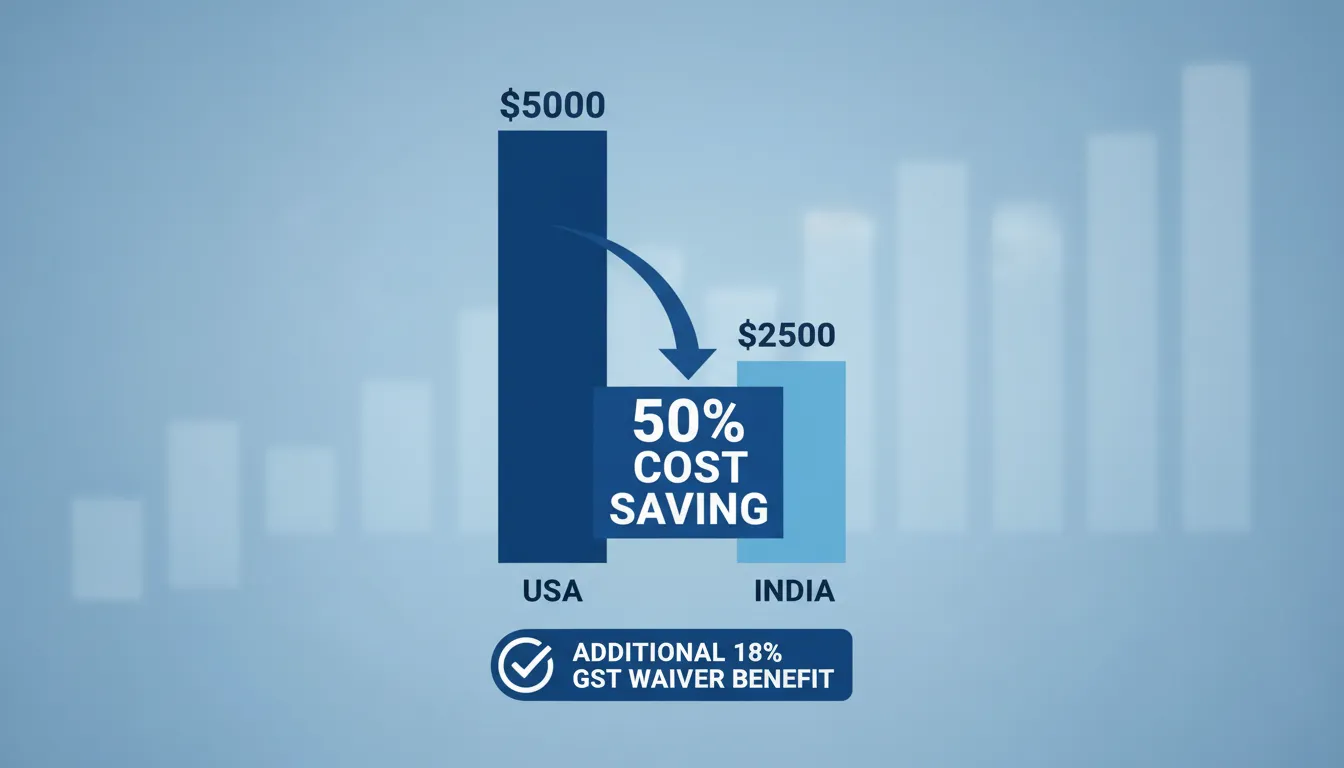

For US-based Non-Resident Indians (NRIs) and expatriates, the Indian term insurance market represents a significant arbitrage opportunity in 2025. While the fundamental premise of term insurance—pure risk protection—remains consistent globally, the cost structures differ radically. Securing coverage in India can result in premium savings of 40% to 60% compared to equivalent US policies, without compromising on claim reliability or coverage scope. This report analyzes the top-tier term insurance instruments available in India for the 2025 fiscal year, specifically calibrated for the US-based consumer.

The Strategic Advantage: Why Source Coverage from India?

The decision to purchase an Indian term plan while residing in the United States is driven by capital efficiency. Indian mortality tables and competitive underwriting have kept premiums historically low. For a healthy 35-year-old male, a ₹2 Crore (approx. $240,000) cover can cost as little as $300–$400 annually. In contrast, a similar policy underwritten in the US often commands double that premium.

Furthermore, the regulatory framework has evolved to favor foreign currency inflows. The Goods and Services Tax (GST) Waiver is a critical fiscal benefit. NRIs paying premiums via Non-Resident External (NRE) accounts or freely convertible foreign currency are eligible for a waiver of the standard 18% GST. This effectively creates an immediate 18% discount on the already lower base premium.

Top-Tier Term Insurance Plans for 2025

Based on Solvency Ratios, Claim Settlement Ratios (CSR), and ease of digital onboarding for US residents, three insurers dominate the 2025 landscape.

1. HDFC Life – Click 2 Protect Super

HDFC Life remains the benchmark for premium underwriting. The Click 2 Protect Super plan is structured for flexibility. It allows for changing coverage needs, such as increasing the sum assured upon life milestones (marriage, childbirth) without fresh medical underwriting—a feature highly relevant for young professionals.

- US Market Relevance: Their digital onboarding is seamless. Medical examinations can often be conducted via tele-medical video calls or through US-based partners, eliminating the need to travel to India.

- Claim Reliability: Consistently maintains a CSR above 99%, indicating superior operational efficiency.

2. Max Life – Smart Secure Plus

Max Life has carved a niche in high-value claim settlement. The Smart Secure Plus plan is notable for its “Claim Guarantee” (subject to terms), promising settlement within a specific timeframe or paying a penalty.

- Key Feature: The “Premium Break” option allows policyholders to skip premiums for a year during financial hardship without policy lapse—a useful liquidity buffer.

- CSR Metric: Max Life frequently leads the industry in individual death claim settlement ratios, often exceeding 99.5%.

3. Tata AIA – Sampoorna Raksha Supreme

Backed by the Tata Group’s brand equity, this plan appeals to conservative investors seeking long-term stability. The Sampoorna Raksha Supreme offers “Whole Life” options, extending coverage up to age 100, which effectively functions as a legacy planning tool.

- US Market Relevance: Excellent integration with foreign remittance systems for seamless renewal payments.

- Wellness Integration: Their vitality program rewards healthy lifestyles with premium discounts, aligning well with the health-conscious demographic in the US.

Comparative Matrix: Fiscal Year 2024-25 Data

The following table consolidates key metrics. Note that Claim Settlement Ratio (CSR) refers to the percentage of claims settled against those received, while the Solvency Ratio indicates the company’s ability to meet long-term liabilities (regulatory requirement is 1.50).

| Insurer | Plan Name | Claim Settlement Ratio (CSR)* | Solvency Ratio | Key Differentiator for US Buyers |

|---|---|---|---|---|

| HDFC Life | Click 2 Protect Super | 99.68% | 1.90+ | Superior tele-medical network & increasing cover options. |

| Max Life | Smart Secure Plus | 99.51% | 1.90+ | High-speed claim processing & “Premium Break” option. |

| Tata AIA | Sampoorna Raksha Supreme | 99.41% | 2.00+ | Whole life coverage (up to age 100) & brand trust. |

| ICICI Prudential | iProtect Smart | 98.15% | 2.00+ | Comprehensive Critical Illness riders & global presence. |

*Data reflects latest available IRDAI annual reports; figures may vary slightly by reporting quarter.

Critical Considerations for US Residents (FAQ)

1. Is the death benefit taxable in the USA?

Generally, life insurance death benefits are income-tax-free in the United States. However, they may be subject to Estate Tax if the total value of your estate (including the insurance proceeds) exceeds the federal exemption limit. Furthermore, since this is a foreign asset, you must ensure compliance with FBAR (Foreign Bank and Financial Accounts) and FATCA reporting requirements if the cash value or account balance exceeds specific thresholds. Always consult a US-certified CPA regarding foreign asset reporting.

2. Do I need to visit India for the medical exam?

No. In 2025, leading insurers like HDFC Life and Tata AIA have robust tele-medical underwriting processes. If a physical test is required, they have tie-ups with third-party administrators (TPAs) in major US cities to conduct the tests locally.

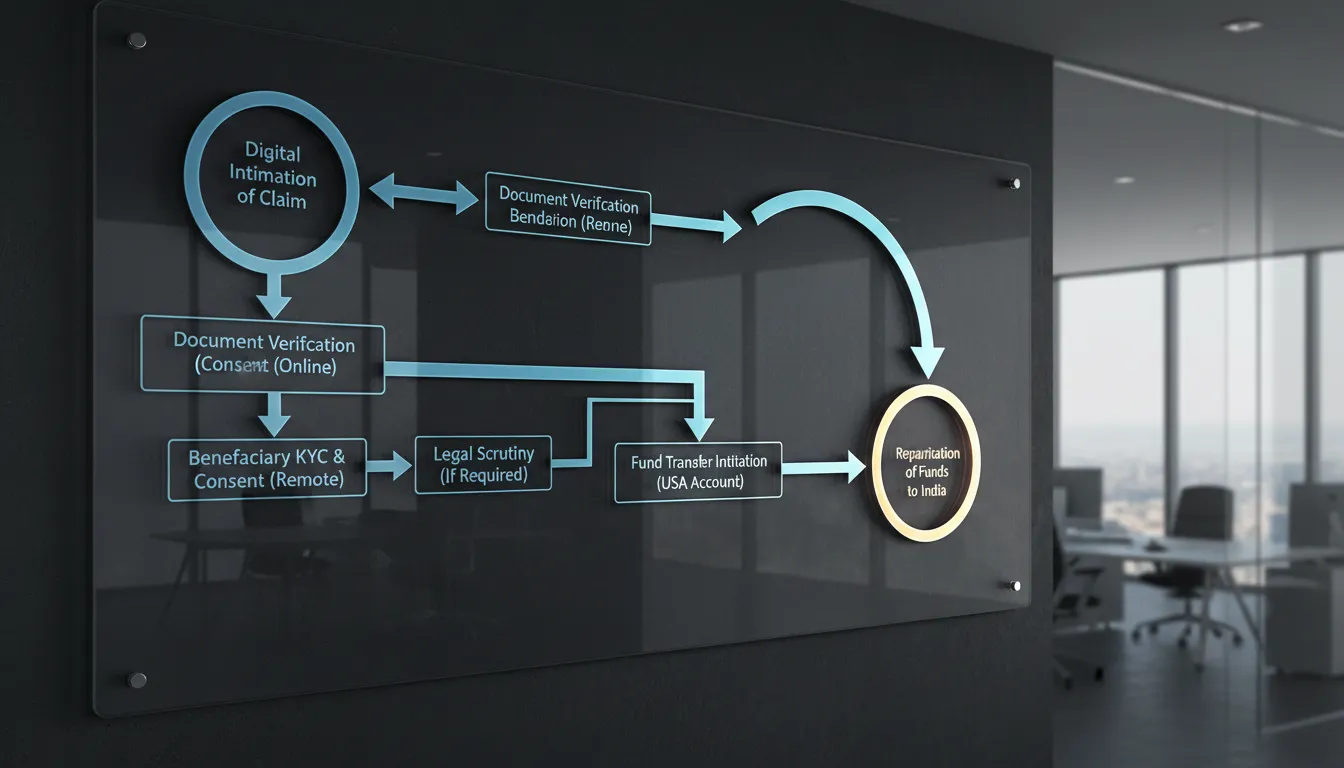

3. How are claims paid out to US beneficiaries?

If the premiums were paid via an NRE account, the claim proceeds are fully repatriable. The insurer will credit the sum assured to the nominee’s NRE/NRO account in India. From there, the funds can be repatriated to a US bank account, subject to FEMA (Foreign Exchange Management Act) guidelines. It is advisable to keep the premium payment source clear (NRE account) to ensure smooth repatriation.

Final Outlook

For the US-based investor, Indian term insurance in 2025 is no longer just a low-cost alternative; it is a sophisticated financial instrument. The convergence of high claim settlement ratios, digital-first underwriting, and the 18% GST waiver creates a compelling value proposition. The “best” plan depends on your specific liquidity needs and coverage duration, but HDFC Life and Max Life currently offer the most streamlined experience for remote, international policyholders.