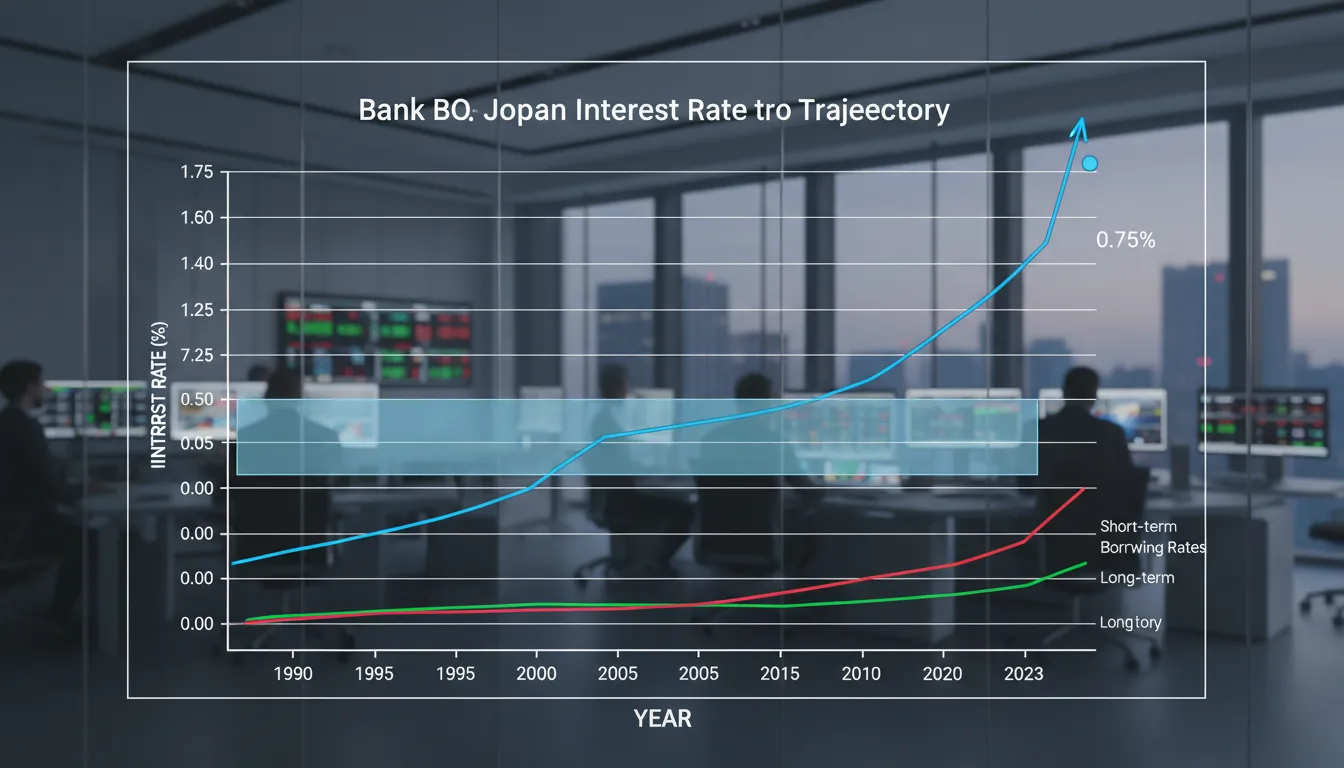

Bank of Japan Ends Era of Cheap Money: Key Rate Hits 0.75%, Highest Since 1995

The Bank of Japan (BOJ) has fundamentally altered the global financial landscape by raising its benchmark interest rate to 0.75%, a level not seen in three decades. This decisive move marks the definitive end of Japan’s ultra-loose monetary policy, sending ripples through global bond markets and signaling a new era of capital cost. For the United States, the implications are immediate and tangible: the days of relying on Japan as a source of near-zero cost liquidity are over, placing upward pressure on U.S. Treasury yields and challenging the stability of the longstanding “carry trade.”

The End of the “Yen Carry Trade” and Its Impact on U.S. Markets

For years, the “yen carry trade” has been a cornerstone of global liquidity. Investors would borrow Japanese yen at rock-bottom rates to invest in higher-yielding assets, such as U.S. stocks and Treasury bonds. With the BOJ’s rate now climbing to 0.75%, the cost of funding these trades has spiked, forcing a reassessment of risk across Wall Street.

Pressure on U.S. Treasury Yields

The most direct impact for U.S. investors is visible in the bond market. Japan is the largest foreign holder of U.S. government debt. As domestic Japanese yields become more attractive—now offering a positive return without currency risk—Japanese institutional investors may repatriate capital. This potential sell-off or reduced demand for U.S. Treasuries contributes to rising yields in the U.S., which directly correlates to higher borrowing costs for American corporations and homebuyers.

Currency Volatility: USD/JPY Dynamics

The rate hike has narrowed the interest rate differential between the Federal Reserve and the BOJ. While the Fed maintains a higher absolute rate, the direction of travel is key. The BOJ is tightening while the Fed has paused or signaled cuts, creating a bullish environment for the Yen. A strengthening Yen makes Japanese exports more expensive but also reduces the purchasing power of the U.S. dollar in Asian markets, impacting the earnings of U.S. multinationals with significant exposure to Japan.

Comparative Analysis: Global Central Bank Divergence

The BOJ’s move stands in stark contrast to other major central banks. While the Federal Reserve and the ECB are navigating a pivot toward easing or holding steady, Japan is actively tightening. This divergence creates a unique friction in global capital flows.

| Central Bank | Current Policy Stance | Key Rate Direction | Impact on US Investors |

|---|---|---|---|

| Bank of Japan (BOJ) | Aggressive Tightening | Up (0.75%) | Higher global bond yields; risk of carry trade unwind. |

| Federal Reserve (Fed) | Data-Dependent / Easing Bias | Stable / Down | Potential for weaker USD against JPY; import price deflation. |

| European Central Bank (ECB) | Neutral / Easing | Stable / Down | Euro may weaken against Yen, affecting cross-border trade. |

Strategic Implications for U.S. Sectors

The ripple effects of a 0.75% Japanese base rate extend beyond currency traders to specific sectors of the U.S. economy.

- Real Estate & Housing: As U.S. Treasury yields rise in response to global bond sell-offs, mortgage rates often follow. American homebuyers could face stubbornly high rates even if the Fed cuts its own policy rate.

- Tech & Growth Stocks: These assets are highly sensitive to the cost of capital. If the unwinding of the carry trade drains liquidity from U.S. equity markets, high-valuation growth stocks could see increased volatility.

- Banking: U.S. banks with significant trading desks may face short-term volatility as hedge funds unwind leveraged positions funded by cheap Yen.

Frequently Asked Questions (FAQ)

Will this rate hike cause a U.S. recession?

Unlikely on its own. While it tightens global financial conditions, the U.S. economy is driven largely by domestic consumption. However, it does remove a layer of liquidity that has supported asset prices, potentially leading to a market correction rather than a full-blown economic recession.

How does this affect my U.S. mortgage rate?

There is a correlation. Mortgage rates are loosely tied to the 10-year Treasury yield. If Japanese investors sell U.S. bonds to buy their own domestic bonds, U.S. yields rise, which can keep U.S. mortgage rates elevated regardless of Fed policy.

Is the U.S. dollar going to crash against the Yen?

A “crash” is improbable, but a correction is expected. The dollar has been historically strong against the Yen due to the wide interest rate gap. As that gap closes, the dollar will likely weaken, making travel to Japan more expensive for Americans but potentially helping U.S. exporters by making their goods more competitive.

Final Outlook: A New Normal for Global Capital

The Bank of Japan’s decision to raise rates to 0.75% is more than a domestic policy shift; it is a structural change in the machinery of global finance. For U.S. stakeholders, the immediate “free lunch” of cheap Japanese liquidity is over. Investors must now navigate a world where capital has a cost everywhere, not just in the West. Expect continued volatility in currency markets and a floor under U.S. bond yields, as the world adjusts to a Japan that is finally paying interest.