In FY 2024, the “protection gap” in India remains a critical concern, with life insurance penetration hovering around 2.8% despite a 6.1% rise in industry premiums.

For the breadwinner of a family, this isn’t just a statistic—it’s a wake-up call. If you are reading this, you likely understand that term insurance is not an investment for you; it is a lifeline for your dependents. But with over 24 life insurers in the market, distinguishing between a marketing gimmick and a rock-solid promise is difficult.

As a Senior Insurance Consultant with two decades of experience analyzing policy wordings and claim histories, I have curated this definitive list of the 10 Best Term Insurance Plans in India for 2024. My methodology goes beyond the brochure. I evaluate the Claim Settlement Ratio (CSR), Solvency Ratio (financial ability to pay), and the fine print regarding critical illness and claim rejection clauses.

Whether you are a salaried professional or part of the growing gig economy—which saw a 50% surge in term plan purchases in 2024—this guide will help you make a decision rooted in data, not emotion.

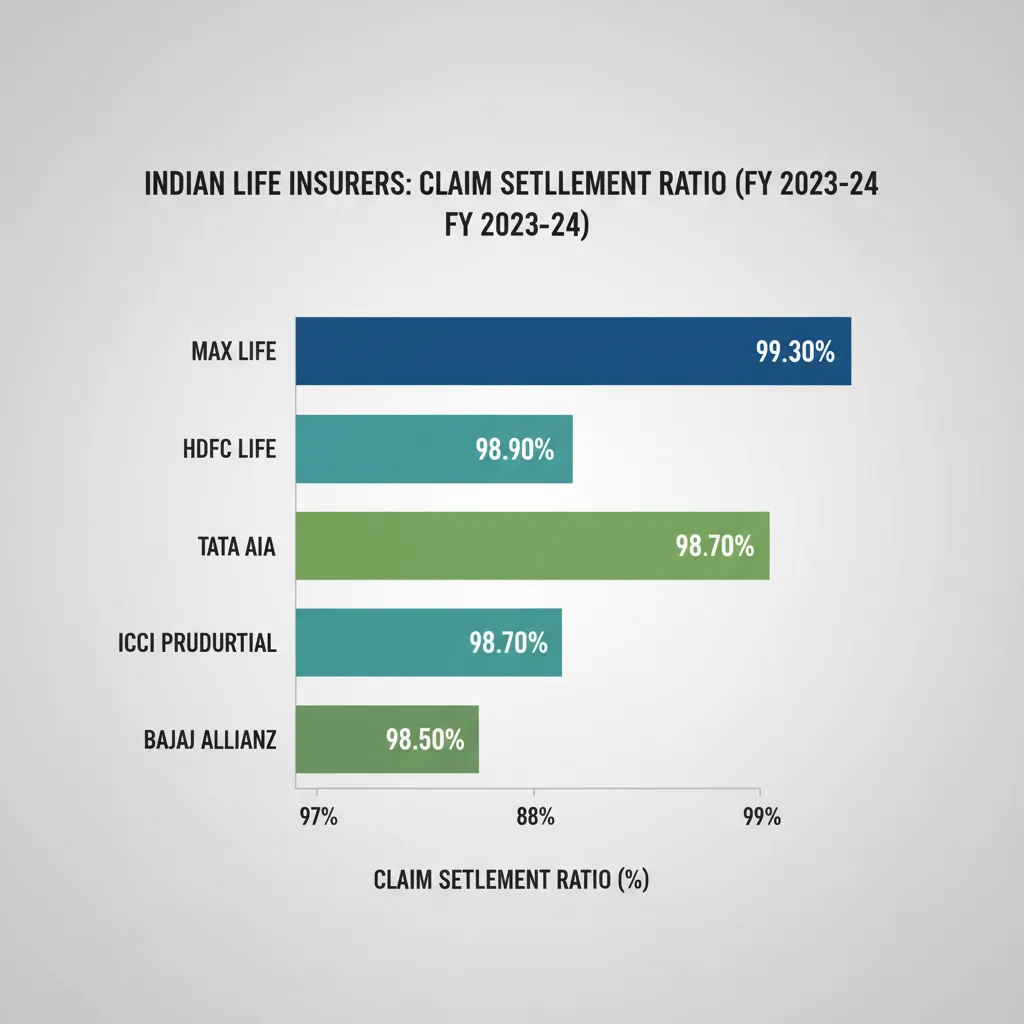

At a Glance: Top 5 Term Plans Compared (2024 Data)

Before diving into the detailed reviews, here is a snapshot of the top contenders based on the latest FY 2023-24 disclosures.

| Insurer & Plan | Claim Settlement Ratio (FY23-24) | Solvency Ratio (Approx. 2024) | Best For |

|---|---|---|---|

| Max Life Smart Secure Plus | 99.65% | ~2.01 | Consistency & High Trust |

| HDFC Life Click 2 Protect Super | 99.50% | ~2.03 | Comprehensive Features & Increasing Cover |

| Tata AIA Sampoorna Raksha Supreme | 99.13% | ~1.80 | Wellness Benefits & Discounted Premiums |

| ICICI Pru iProtect Smart | 99.17% | ~2.12 | Critical Illness & Terminal Illness Cover |

| Bajaj Allianz Life eTouch | 99.23% | ~4.32 | Financial Strength & Flexibility |

*Note: Solvency Ratio mandate by IRDAI is 1.50. A ratio above 1.80 is considered very healthy. Bajaj Allianz’s ratio of ~4.32 is exceptionally high, indicating massive liquidity surplus.

Methodology: How We Ranked These Plans

To ensure this list is authoritative and unbiased, I utilized a weighted scoring model based on the following criteria:

- Claim Settlement Ratio (CSR): The percentage of claims settled against those received. We prioritized insurers consistently above 98% over a 3-year period.

- Solvency Ratio: An indicator of the company’s financial health. While the regulatory requirement is 1.5, top-tier insurers typically maintain 1.9 or higher.

- Features & Flexibility: Availability of riders (Critical Illness, Accidental Death), policy terms (up to age 85 or 99), and premium payment options.

- Customer Experience: Ease of onboarding, medical checkup processes, and digital claim intimation capabilities.

In-Depth Reviews: The 10 Best Term Insurance Plans

1. Max Life Smart Secure Plus

The Gold Standard for Claim Settlement

Max Life has consistently set the benchmark for claim settlement in the private sector. With a CSR of 99.65% for FY 2023-24, they are arguably the most reliable private insurer when it comes to honoring commitments. The “Smart Secure Plus” plan is versatile, offering two distinct death benefit variants.

- Key Feature: The “Break Free” option allows you to take a premium holiday if you face financial constraints, without the policy lapsing (subject to conditions).

- Why it Wins: Their “Insta-Claim” promise settles claims up to ₹1 Crore within 1 day for eligible policies (3+ years old).

- Consultant’s Verdict: If your primary goal is peace of mind regarding claim payment, this is your top choice.

2. HDFC Life Click 2 Protect Super

Best for Evolving Life Stages

HDFC Life is a heavyweight in the industry with a CSR of 99.50%. The “Click 2 Protect Super” is an evolution of their famous 3D Plus plan. It stands out for its flexibility to adapt to changing life needs.

- Key Feature: The “Life Goal” variant allows you to reduce your cover (and premiums) as your liabilities decrease closer to retirement—a smart way to save money.

- Smart Exit Benefit: You can exit the policy at a specific age and get a refund of all premiums paid, essentially making it a “free” term plan if you survive the term.

- Consultant’s Verdict: Ideal for young professionals who anticipate their coverage needs will change over time (marriage, home loan, children).

3. ICICI Prudential iProtect Smart

Best for Critical Illness Coverage

ICICI Prudential’s iProtect Smart is one of the most popular plans in India, and for good reason. It integrates health protection seamlessly with life cover. Their CSR stands strong at 99.17%.

- Key Feature: It covers 34 Critical Illnesses (like cancer, heart attack) and pays the claim amount immediately upon diagnosis, without requiring hospital bills. This is a “benefit” policy, not an “indemnity” one.

- Terminal Illness Benefit: If diagnosed with a terminal illness, the entire death benefit is paid out immediately to help with treatment or bucket-list wishes.

- Consultant’s Verdict: Highly recommended if you do not have a separate comprehensive Critical Illness policy.

4. Tata AIA Sampoorna Raksha Supreme

Best for Wellness & Health Integration

Tata AIA has surged in popularity due to its CSR of 99.13% and its unique “Vitality” program. This plan rewards you for staying healthy.

- Key Feature: The Tata AIA Vitality program offers upfront discounts on premiums and further rewards (like renewal discounts) if you meet wellness targets (steps, health checkups).

- Life Stage Benefit: You can increase your coverage without new medicals upon marriage or the birth of a child.

- Consultant’s Verdict: Perfect for health-conscious individuals who want to be financially rewarded for their active lifestyle.

5. Bajaj Allianz Life eTouch

Best for Financial Strength & Solvency

Bajaj Allianz boasts a staggering Solvency Ratio of ~4.32 (March 2024), far exceeding the regulatory requirement of 1.5. This indicates massive financial reserves. Their CSR is also excellent at 99.23%.

- Key Feature: The plan is highly customizable with options for Accidental Death Benefit and Waiver of Premium on disability.

- Payout Flexibility: You can choose to have the death benefit paid as a lump sum, monthly income, or a combination of both to help your family manage cash flow.

- Consultant’s Verdict: A financial fortress. If you worry about an insurer’s ability to survive economic downturns, Bajaj Allianz is a safe harbor.

6. LIC Tech Term

The Sovereign Trust Factor

While private players offer lower premiums, LIC remains the behemoth with a sovereign guarantee (Section 37 of the LIC Act). The Tech Term is their online-only pure risk plan.

- Stats: Solvency Ratio of 1.98 (March 2024).

- Pros: Unmatched trust factor, especially in tier-2 and tier-3 cities.

- Cons: Premiums are generally higher than private competitors, and the online buying journey can be less intuitive.

7. SBI Life eShield Next

Best for Banking Ecosystem Trust

Backed by India’s largest bank, SBI Life offers the “eShield Next” which provides three plan options: Level Cover, Increasing Cover, and Level Cover with Future Proofing.

- Key Feature: The “Better Half Benefit” allows you to cover your spouse under the same policy, ensuring comprehensive family protection.

- Consultant’s Verdict: A solid middle-ground for those who want the trust of a PSU (State Bank) with the efficiency of a private insurer.

8. Kotak e-Term

Best for Cost-Effectiveness

Kotak Life offers one of the most competitively priced plans in the market. With a CSR of ~98.82%, they are a reliable player.

- Key Feature: Very affordable premiums for non-smokers. They also offer a “Step Up” option to increase cover annually.

- Consultant’s Verdict: If you are on a strict budget but refuse to compromise on the quality of the insurer, Kotak e-Term is the value pick.

9. Aditya Birla Sun Life DigiShield

Best for Customization

This plan is known for its “hyper-customization.” You can tweak almost every aspect, from policy term to premium payment term (PPT).

- Key Feature: Return of Premium (ROP) option is available and flexible. While I generally advise against ROP (as it increases premiums), some clients prefer the psychological comfort of getting money back.

10. PNB MetLife Mera Term Plan Plus

Best for Coverage Options

PNB MetLife has improved its service metrics significantly. This plan offers coverage up to age 99, effectively acting as a legacy planning tool.

- Key Feature: Joint Life cover options and coverage against 50 Critical Illnesses.

Market Trends 2024: What’s Changing?

The insurance landscape in India is shifting rapidly. Here are two trends impacting buyers this year:

- Rise of the Self-Employed: In 2024, term insurance purchases among self-employed individuals surged by 50%. Insurers have responded by relaxing income proof requirements (no longer strictly demanding 3 years of ITR for all covers) and creating tailored plans for gig workers.

- Premium Hikes: The industry saw a 6.1% rise in premiums in FY 2023-24. This is due to reinsurance rates hardening globally. Actionable Advice: If you are sitting on the fence, buy now. Premiums for term insurance are locked for life; delaying by a year could mean paying a higher rate for the next 30 years.

Conclusion: Which Plan Should You Pick?

There is no single “best” plan for everyone, but there is a best plan for you.

- For absolute peace of mind: Go with Max Life Smart Secure Plus or LIC Tech Term.

- For feature-rich coverage: Choose HDFC Life Click 2 Protect Super.

- For comprehensive health protection: ICICI Pru iProtect Smart is the winner.

- For financial stability: Bajaj Allianz Life eTouch offers unmatched solvency.

Final Advice: The best term insurance is the one you buy today. Procrastination is the biggest risk to your family’s financial future. Ensure you disclose all medical history (smoking, drinking, pre-existing conditions) honestly. A slightly higher premium for a “rated up” policy is infinitely better than a rejected claim.

Frequently Asked Questions (FAQ)

What is the minimum Claim Settlement Ratio (CSR) I should look for?

You should look for an insurer with a Claim Settlement Ratio (CSR) consistently above 98% over the last 3 years. For FY 2023-24, top insurers like Max Life, HDFC Life, and Tata AIA all exceeded 99%.

Is the premium for term insurance refundable?

In a pure term insurance plan, premiums are not refundable if you survive the term. However, “Return of Premium” (ROP) plans exist where you get your premiums back at maturity, but these plans are significantly more expensive and generally not recommended by financial experts due to the opportunity cost of the extra premium paid.

Can I buy term insurance if I am a smoker?

Yes, smokers can buy term insurance, but the premiums will be 30-50% higher than for non-smokers. It is crucial to disclose your smoking habit; otherwise, the insurer can reject the claim later on grounds of non-disclosure.

What is the ideal life cover amount?

A general rule of thumb is to have a cover that is 15 to 20 times your annual income. For example, if you earn ₹10 Lakhs per year, you should aim for a cover of ₹1.5 Crore to ₹2 Crore to ensure your family can maintain their lifestyle and pay off debts.

Does term insurance cover death outside India?

Yes, standard term insurance plans cover death anywhere in the world. However, you must inform your insurer if you are moving abroad permanently or to a high-risk country, as this might affect your policy terms.